Opinion

It’s time for telcos to step up as drivers of industrial 5G

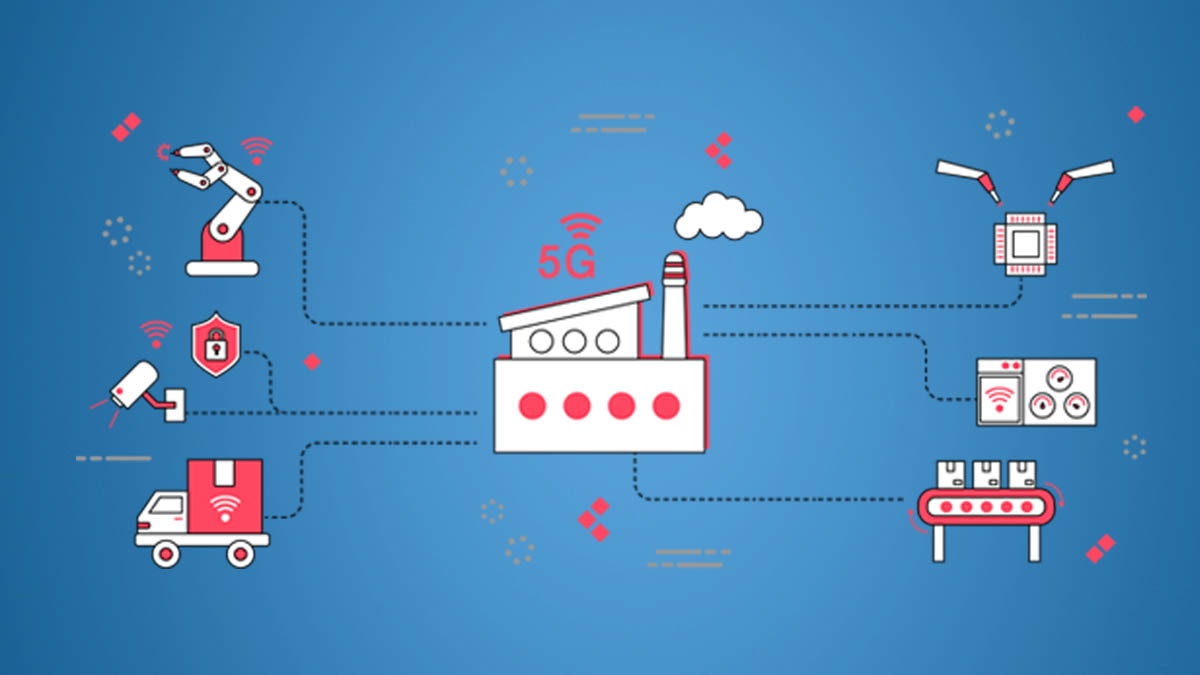

Industrial 5G is set to be a catalyst for unlocking the potential of intelligent industry and accelerating data-driven digital transformation. However, most organizations are yet to realize its true potential. A variety of challenges await industrial organizations as they navigate their 5G roadmaps, and now is the time for telcos to step in and aid manufacturers in achieving their ambitions.

Quite rightly, manufacturing firms widely recognize 5G as the cornerstone of the next generation of Industry 4.0. The combination of high capacity and coverage is making mid-band 5G a particularly attractive choice for a variety of new and transformative industrial use cases.

Recently, we conducted research on 5G in manufacturing and found that 40 percent of industrial organizations expect to roll out 5G at scale at a single site within two years.

Telcos are aware of the opportunity this presents, and they’ve been busy preparing. More than two thirds (68 percent) have already launched commercial 5G services, while the remaining third are at advanced stages of rollout.

However, as is the case with many endeavours, the COVID-19 pandemic has caused significant delays in implementation. This has led to slowed standards development, and delays in spectrum auctions, not to mention the supply chain disruptions, which have impacted telcos’ original equipment manufacturers (OEMs). Yet these challenges have ultimately proven to be short-lived, and now governments and enterprises are accelerating their deployments.

Now that the wheels are in motion for 5G projects, telcos need to step-up and drive these projects forward, and there are several different ways in which they can do so.

More than connectivity

Telcos need to finally unburden themselves from their historical role as mere ‘connectivity providers’. In the 5G world they must act as a solution-driven provider equipped with value-added services — one that is fully aligned with, and is an integral part of, the manufacturers’ digital transformation journeys.

We know that more than half of telcos are aware of these opportunities, but the question remains: how can telcos turbocharge their current offerings with vertical-specific solutions that integrate connectivity, platforms, applications, and devices directly to enterprises?

Private networks and the edge

When industrial organizations plan their 5G initiatives, private 5G networks are the preferred choice, as they provide complete control over their networks and data along with high performance levels.

Our study found that telcos are aligning their enterprise 5G strategy with the demand for private 5G networks. Two-thirds (63 percent) have also launched industrial grade private network solutions to address the private network opportunity and meet the needs of industrial customers.

Verizon, for instance, sees itself as an end-to-end partner for private 5G network implementations, positioning itself to provide services along the customer journey: from helping organizations purchase local 5G spectrum to setting up and managing the private networks on their behalf.

Industry demand for low latency applications and real-time data and analytics continues to grow, with edge computing acting as a key enabler. Because of this, the market for edge computing is estimated to reach USD15.7 billion by 2025.

Take AT&T for example, its on-premises edge portfolio already includes 5G-capable edge computing, and Verizon has also launched a 5G-based edge platform. Telcos therefore must seize the opportunity and incorporate 5G-enabled edge computing services or strategies into their wider business development agenda.

Paint the benefits of 5G

Despite the increasing awareness around the benefits and opportunities presented by 5G, many industrial organizations are still not clear on whether 5G features will translate into practical applications on the ground.

Telcos should take proactive steps to educate industrial customers by demonstrating the impact of 5G in client-specific industrial environments, share real-world results of pilot projects and trials, or even provide a lab like T-Mobile, or create a lightweight platform. Capgemini has also developed 5G Labs in Paris and Mumbai to showcase industrial use cases and manifest new perspectives for industrial clients..

Play an active role

Telcos can play an active role in simplifying manufacturers’ path to 5G adoption and lay a strong foundation for their 5G implementations. By taking a deep dive into customers’ business problems and KPIs, while bringing together viewpoints from stakeholders across the business, telcos can help map out priority areas.

Belgium-based operator Citymesh, for instance, identified more than 100 use cases for one of its clients, based on extensive discussions with stakeholders from across the organization. It has presented a solid starting point for 5G implementations by helping organizations see the full set of possibilities that 5G can offer them before they identify priority areas.

Telcos can also consider simplifying access to vertical-specific solutions by providing them as an as-a-service/ subscription-based model, and onboard suitable partners rapidly to tailor specific industrial 5G use cases. To weather the rapid globalization process, telcos should also develop scalable and global solutions that address the 5G networking needs for a worldwide industrial customer base.

Manufacturers have varying needs, so telcos should offer a portfolio of solutions that address multiple network deployment scenarios, including private or dedicated, hybrid or virtual hybrid, all with clear service level agreements (SLAs). Telcos must also stay focused on security and sustainability to ensure that the networks they help build are resilient and future-proof.

Creating the ecosystem for tomorrow

Industrial executives are now seeking solutions that enable them to not worry about managing a multi-vendor 5G environment. Telcos should therefore focus on building an integrated service offering that combines connectivity with devices, applications, and the security layer – all of which are essential components of an overall 5G solution.

This will require building trusted relationships with a range of ecosystem partners, including cloud providers, edge computing providers, network equipment vendors, hardware providers, and system integrators.

Looking at real life cases, South Korea’s SK Telecom launched a subscription-based smart factory solution for small and medium-sized enterprises (SMEs) that enables organizations to optimize equipment maintenance using 5G-enabled sensors placed on manufacturing equipment.

Only by working together with cloud providers, OEMs, and other partners to build a holistic ecosystem of devices, solutions, and service offerings, can telcos successfully unleash the possibilities of 5G and accelerate adoption in the industrial sector.

Opinion

Amid Mobile Operator Price Increases, Here’s How to Avoid the Hike

Feeling the Pinch?

The rising cost of living is difficult to avoid. April 2022 saw food prices increase by 6.7 per cent, the highest petrol prices on record and inflation rise to a staggering nine per cent. As millions of customers see their mobile tariffs soar, Ross Slogrove, UK country manager at cloud calling specialist Ringover reveals his advice for avoiding the price hike.

From July 1, 2022, Virgin Media will hit its 3 million customers with a price hike of 1.5 per cent. So, if a customer signed up to, let’s say, a £30-a-month tariff after May 5, 2022, they will pay an additional 45 pence each month. EE has already increased its prices by 2.7 per cent each year — or £11.30 if you have a £35-a-month contract — while O2, Three and Vodafone are all increasing by 2.5 per cent.

Pay-as-you-go prices are also taking a hit. From July 2022, call costs with Three will jump from 10p to 35p per minute. The cost of sending a text will double, affecting the 14 per cent of Brits that use a pre-pay mobile.

Given Brits are already battling with price hikes from every angle, these costs mount up. 45 per cent of UK households have at least two mobile phones, while according to Ofcom, just two per cent don’t have one at all. And then there’s the toll on businesses, with many still relying on mobile packages to keep employees connected.

Take a Hike

When a mobile contract comes to an end, it’s common for that tariff to be rolled onto a monthly rolling contract at the same price, even though the customer has paid off their handset. Research from Which? shows that customers who allow their mobile phone contracts to roll over without enquiring about better deals could lose up to £100 a year.

Ditching a contract mid-term and without penalties isn’t possible. However, consumers should evaluate whether their minimum contract period has ended if they’re considering switching. If a customer was on a standard 24-month contract that’s rolled on after this, they’re probably over-paying and need to negotiate a better deal.

Claiming that mobile phone networks overcharged UK businesses and consumers by £7.6 million last year, BillMonitor can provide analysis into the best mobile tariffs for your needs. Money Saving Expert has an easy-to-use price comparison tool, too.

Ditch the Big Guys

Some research into mobile virtual network operators (MVNOs) may also be worthwhile. Unlike the “Big Four” mobile network operators (MNOs) in the UK, MVNOs do not own their own wireless infrastructure, so use radio networks operated by EE, O2, Three and Vodafone. They include the likes of Giffgaff,Tesco Mobile and Sky.

In Which?’s Annual Mobile Network Survey of the best perceived mobile operators, O2, EE, Vodafone and Three were outperformed by MVNOs. Three fared poorly in the customer survey, receiving the lowest rating for network reliability with customers unimpressed by its technical support.

In contrast, virtual networks Smarty and iD, which both use Three’s infrastructure, were among the highest scorers in Which?’s table with customers applauding the networks’ value for money. Three of the highest scoring carriers in Which?’s survey were Giffgaff, Tesco and Sky, which all use O2’s infrastructure.

Head to the Cloud

Shopping around and switching providers will save consumers from the Big Four’s price hikes, but what about businesses? It may be best for them to ditch traditional telephony altogether.

There are currently 4.98 million business landline numbers in use, according to Ofcom figures. However, this is expected to drop below 2 million by 2024, from a high of 8 million in 2013. With the switch off of the public switched telephone network (PSTN) imminent, businesses that rely heavily on calling should consider an internet-based alternative.

Voice over Internet Protocol, or VoIP, is often a cheaper alternative to traditional telephony. While a traditional landline phone system sends voice communications via an analogue PBX system, VoIP phone systems transmit voice calls over the internet as data packets to bring voice and data capabilities together on a single network, eliminating the need for separate lines and providers for each.

A company using a VoIP service doesn’t need to work with multiple service providers for its office, mobile, and data services, IT support is reduced and hardware and installation needs are condensed. Furthermore, because users are no longer tied down to a particular country, address or phoneline for their communications, companies can save on the cost of international charges.

With the cost of living rising, price hikes are difficult to avoid. However, consumers must check in on their current mobile contracts or they risk losing money. For businesses, it’s time to move on from the landline and onto more cost-effective, future-proofed alternatives.

About Ringover

A leader in cloud communications, Ringover seamlessly combines unlimited calling, group messaging and video conferencing into one easy-to-use app. No expertise is needed to set up and integrates with your CRM or helpdesk tools. Within a few clicks, you’ve gained access to all the data you need to enhance your call centre or sales team’s performance and boost customer engagement.

Opinion

The Big Tech Telecoms Convergence: Dream or Disaster?

Big Tech’s entry into telecoms is shaking up the industry

2021 was a huge year for tech giants and telecoms with Google, Verizon and most recently Amazon Web Services (AWS) all announcing plans to enter the telecoms space. The convergence of Big Tech telecoms is nothing new and each company has their own plans to disrupt the current landscape for the better. But is this disruption a dream or disaster for telcos? Here, Hamish White, CEO of digital-first telecom software provider Mobilise, navigates the benefits and drawbacks of the growing tech-telecom convergence.

Despite seeming similar, in many ways telecoms and Big Tech are polar opposites. While Big Tech tends to position itself at the forefront of innovation, paving the way for new upcoming capabilities, the telecoms industry tends to stick to its traditional but stable principles and ways of working. But could a unification be just what’s needed?

Better Together

Big Tech’s entry into telecoms has a wealth of potential for service providers (SPs) and their customers. Big Tech has what many providers are lacking — the resources, financial resources and culture to accelerate the pace of innovation of the telecoms industry by applying a Big Tech approach product development and improvement. Big Tech brings its own way of innovating to the market, resulting in quicker, better products and services that smaller providers can tap into too.

This has a positive knock-on effect on consumers, who ultimately receive a better experience from their SP. Through their advance data management techniques, Big Tech has the potential to gather, organise and present more customer data from various sources. The more a SP knows about its customer, the greater the level of personalisation they can offer. A greater level of personalisation leads to more relevant marketing, great customer satisfaction and increased customer lifetime value (CLV) for the SP. A win-win for both the SP and the customer.

Personalisation is complicated to deliver, often requiring significant investment on new technology and involvement from stakeholders across the business. As a result, smaller and medium-sized providers often cannot offer personalisation services on par with Big Tech or Tier 1 SPs, leaving them uncompetitive and missing out entirely on new opportunities.

With the help of Mobilise’s HERO platform, small and medium-sized SPs can now deliver personalisation on par with industry leaders. This is because they have access to all customer data needed for such services through one central location which also houses an orchestration layer which acts as a single entry point between interconnected systems in order to capture the data required for hyperpersonalisation.

Fair Share

Despite the potential benefits that Big Tech could bring to the telecoms market, there’s also shared concerns from mobile operators all over the world. SPs’ ongoing dissatisfaction with Big Tech’s lack of investment into the physical telecommunications infrastructure has been documented publicly.

In December 2021, the Financial Times published an open letter from Europe’s 13 biggest SPs addressing tech giants to demand a greater contribution to network investment. Why is this so crucial?

Data from Sandvine’s Global Internet Phenomena Report revealed the top six tech firms are generating over 56 per cent of global network traffic. Their entire business model and profitability relies on the infrastructure funded by SPs, but despite their successes, they’re still not contributing investment that is commensurate with the gains they’ve reaped.

What’s more, telecoms’ frustration with Big Tech’s lack of infrastructural investment is without even considering the latest layer of the problem: Big Tech’s attempt to launch products and services that directly compete with SPs.

A Market Monopoly

Several tech giants are developing or already have developed telecoms business areas. There’s concern from regulators, SPs and consumers that if Big Tech’s expansion continues, they could monopolise the entire technology sphere.

From a SP’s perspective, monopolisation has already begun. AWS and Microsoft have both acquired SAS-SM accreditation, required for the cloud deployment of one of telecoms’ latest development: eSIMs. eSIMs allow SPs to onboard subscribers remotely, virtually performing the traditional functions of a physical SIM card, directly provisioning a device over the internet.

While the intentions behind AWS and Microsoft’s acquisition of this accreditation are unclear now, it’s possibly linked to the development of eSIMs for Internet of Things (IoT) use cases covering sectors like manufacturing and supply chains, where their use improves operational efficiency.

While Big Tech is free to do this, and has the technology and resources to develop products quickly, this approach of cherry picking certain areas of the telecoms network could negatively affect the industry.

Double-Edged Sword

The implications of Big Tech’s lack of infrastructural investment is concerning. Currently, SPs are entirely responsible for the physical infrastructure that keeps our modern digital societies connected. But as of yet, Big Tech’s shown no interest in supporting this activity.

If Big Tech continues to only cherry pick certain elements of telecoms it wishes to enter, it could jeopardise the revenue SPs can make from their products and services, reducing investment availability, which could then place the critical infrastructure under threat.

There’s buzz from regulators and consumers around the impact of Big Tech’s potentially anti-competitive app store practices. In the US, in February 2022 the Senate passed the Open App Markets Act, which seeks to remove the control of Apple and Google over their app stores, creating a more accessible and diverse market. Similarly, in the EU, in October 2022 the Digital Markets Act will be adopted, banning practices used by Big Tech to gatekeep information and encourage competition.

While these steps promote consumer choice and a fair market, regulators also must consider how Big Tech’s partial entry into telecoms could have a detrimental impact on infrastructure development. The juxtaposition we see is that Big Tech could provide much needed innovation to the telecoms industry, but the infrastructure required to support this innovation won’t exist. Mobilise offers a suite of advisory services, including strategy and regulatory policy consultancy, to assist SPs and regulators in navigating these uncertain times and to see Big Tech as an opportunity rather than a threat.

The tech-telecom convergence will undoubtedly shake up the market. But more consideration needs to be taken to ensure infrastructure investment remains stable and the market remains competitive.

About Mobilise

Mobilise is a leading provider of SaaS solutions to the telecommunications industry. Focused on delivering highly engaging digital-first service propositions with excellent customer experience, Mobilise has a proven track record, deep industry knowledge and a team of specialists to support clients to building and executing transformational strategies.

Clients range from large corporate organisations with over 100,000 employees to small enterprises with under 20 employees. Mobilise has a deep knowledge of the telecoms business model and our experience includes working with over 40 service providers across eight markets for brands including Virgin, Dixon’s Carphone, Red Bull Mobile, Manx Telecom and Freenet.

Opinion

How Does an API-led Connectivity Model Elevate User Experience?

A seamless UX enabler

In its Top 7 trends shaping digital transformation in 2022 report, Mulesoft claimed the 2020s as the era of seamless digital experiences, enabled by modular software design. All more often, consumers are expecting the same quality of user experience (UX) from their service provider (SP) as they receive from tech giants like Amazon and Meta. Here, Hamish White, founder and CEO of telecoms SaaS solution provider Mobilise explains how a composable business model and a modular API-led connectivity architecture is an SP’s best friend.

Organisations that have adopted innovation must not just be able to use it, but use it well enough to deliver a seamless digital UX. Consumers expect the same highly engaging experience from every single brand they interact with, so smaller SPs must offer a UX that’s on a par with tech giants to remain competitive and keep their customers happy.

Offering digital services is essential in our modern digital society. A consistent, intuitive user interface is a core differentiator for SPs seeking a competitive edge, contributing to a positive CX and ultimately preventing churn. According to PricewaterhouseCoopers’ Future of CX report, 32 per cent of all customers would stop doing business with a brand they once loved after just one bad experience. So, a positive UX right from the start is crucial.

APIs Enter the Chat

In today’s digital society, data is king. But despite the widespread recognition of its power, most organisations don’t have a comprehensive data strategy in place. According to Capgemini’s Master the customer experiencereport just 21 per cent of brands have an integrated, holistic view of all customer information. For the others, data is scattered in silos in incompatible formats, and in some cases it’s not even captured and stored. But APIs help to solve these issues.

API-led connectivity links data to applications through application programming interfaces (APIs). It decouples data from the business logic and experience layer to create functions specifically with CX in mind. APIs are developed for specific purposes, but once created, they are reusable. So, adopting an API-led connectivity model allows an organisation to create ecosystems of applications that are modular, purposeful and reusable, enabling businesses to operate with more agility.

Elevating CX

Implementing API integrations, or an orchestration layer, into an organization’s digital infrastructure supports digital CX in many ways. APIs enable the full integration of external systems and third-party services so that processes appear seamless. What is actually a sequence of several individual processes and triggers behind the scenes, enabled through applications from several vendors, can appear as single interaction to a customer.

For example, in telecoms, when onboarding a new customer through an in-app eSIM subscription, subscriber provisioning, stock management and Know Your Customer (KYC) is all handled by APIs. Yet for the customer, all that’s required is the tap of a button.

For smaller SPs, having the resources and expertise to successfully implementing a API-led digital architecture may seem an impossible task. Mobilise’s HERO is a digital BSS platform that enables SPs to deliver digital-first customer experience. Through its orchestration layer, which is fully compliant with the TM Forum Open API Specifications, there are over 60 APIs available to integrate into front and back-end systems, for functions including self-service, eSIM provisioning, payments, in-app push notifications, marketplace for cross selling, and user profiles maintenance.

Preventing churn, maintaining satisfied customers and elevating CX is essential to success in the ever more competitive telecoms space. Creating a consistent, intuitive digital ecosystem, powered by APIs gives SPs the ongoing flexibility to adapt and keep pace with innovation.

About Mobilise

Mobilise is a leading provider of SaaS solutions to the telecommunications industry. Focused on delivering highly engaging digital-first service propositions with excellent customer experience, Mobilise has a proven track record, deep industry knowledge and a team of specialists to support clients to building and executing transformational strategies.